Wave vs. QuickBooks: Which Accounting Software Fits Your Business Needs?

- CodeMasters Marketing

- Feb 9

- 7 min read

Updated: Feb 24

Managing finances is a critical aspect of running a business, and choosing the right accounting software can significantly impact efficiency and growth. Wave and QuickBooks are two prominent options in the market, each offering distinct features tailored to different business sizes and needs. This article provides a comprehensive comparison to help you determine which platform aligns best with your business requirements.

If you're exploring accounting solutions, you may also be interested in the best accounting software for startups to find a system that scales with your business. For companies handling contractor payments, the best 1099 software for accountants can simplify tax reporting. Additionally, automating financial tasks can save time—consider the best automated invoice processing software for U.S. businesses to streamline invoicing.

Overview

Wave: Best for Freelancers and Small Businesses

Wave is a free accounting software designed for freelancers, solopreneurs, and small businesses that need basic financial management without ongoing costs. It includes essential features such as invoicing, expense tracking, and basic reports. While it offers a paid add-on for payroll and payment processing, its core functions remain free, making it an excellent choice for those on a budget.

For businesses that do not require advanced automation, inventory tracking, or deep integrations, Wave is a user-friendly and cost-effective solution. It is best suited for service-based businesses and entrepreneurs who primarily handle invoicing and cash flow management.

Pros | Cons |

✅ Free core accounting tools | ❌ No built-in inventory tracking |

✅ Simple and easy to use | ❌ Lacks advanced automation features |

✅ Unlimited users included | ❌ Limited integrations compared to QuickBooks |

✅ Affordable add-ons for payments and payroll | ❌ Basic reporting features only |

QuickBooks Online: Best for Growing and Established Businesses

QuickBooks Online is a feature-rich accounting solution designed for small to medium-sized businesses that need scalability, automation, and deeper financial insights. It includes advanced invoicing, inventory management, project tracking, and expense categorization. Businesses that require collaboration with accountants or have more complex tax and reporting needs will benefit from QuickBooks' extensive features.

With integrations for eCommerce, payroll, and CRM tools, QuickBooks Online is ideal for businesses looking for a long-term financial management solution. While it has a learning curve, it provides strong customer support, making it easier for users to navigate its extensive capabilities.

Pros | Cons |

✅ Advanced automation and reporting | ❌ Monthly subscription required (starting at $30) |

✅ Inventory and project tracking included | ❌ Can be overwhelming for beginners |

✅ Strong integration with third-party tools | ❌ User limits apply based on the pricing plan |

✅ Great for businesses with complex financial needs | ❌ Higher cost for full feature access |

Key Feature Comparison: Wave vs. QuickBooks Online

Feature | Wave 🏆 (Best for Freelancers) | QuickBooks Online 🔥 (Best for SMBs) |

Pricing | Free (with optional paid features) | Starts at $30/month (80% off for 8 months) |

Invoicing | Unlimited invoices, manual reminders | Automated invoicing & late payment reminders |

Expense Tracking | Basic expense entry, no auto-categorization | Advanced tracking with AI categorization |

Bank Reconciliation | Manual transaction matching | Auto-sync & AI-powered reconciliation |

Inventory Management | ❌ Not available | ✅ Available in Plus & Advanced plans |

Payroll Integration | Paid add-on, limited tax support | Paid add-on, full automation & tax compliance |

Reporting & Analytics | Basic reports (P&L, cash flow) | Customizable reports with detailed analytics |

Multi-User Access | Unlimited users, no roles/permissions | Limited by plan (1-25 users), role-based access |

Third-Party Integrations | Limited, basic payment processing | 750+ integrations (Shopify, CRM, eCommerce) |

Customer Support | Email support only | 24/7 Phone & Chat Support |

User Interface and Ease of Use

Wave

Wave is designed with simplicity in mind, making it an excellent choice for users who have minimal accounting experience. The interface is clean and intuitive, allowing small business owners to easily navigate key features like invoicing, expense tracking, and financial reporting.

The dashboard presents an overview of financial health, and users can quickly generate reports without needing deep accounting knowledge. The mobile app also provides a seamless experience, ensuring that business owners can manage their finances on the go.

QuickBooks Online

QuickBooks Online offers a more feature-rich experience, but this comes at the cost of a steeper learning curve. The interface is well-organized, but due to its extensive functionalities, it may take some time for new users to become fully comfortable with the platform.

However, QuickBooks provides extensive tutorials, guides, and customer support to assist with onboarding. The advanced automation features, reporting tools, and integration options make it a powerful solution for businesses that require more comprehensive financial management. The mobile app also mirrors the desktop experience, allowing users to manage finances from anywhere efficiently.

Optimizing Your Accounting Workflow

Selecting the right accounting software is just the first step in financial management. If you're looking to integrate accounting with customer management, check out Pipedrive vs. Monday.com to find a CRM that complements your financial processes. For businesses looking to improve online visibility and attract more clients, learning how to create an SEO content strategy can help drive leads. If you’re comparing more accounting platforms, don’t miss Xero vs. QuickBooks Online for another detailed breakdown.

Pricing Comparison: Wave vs. QuickBooks Online

Both Wave and QuickBooks Online offer different pricing models based on their target users. Wave provides a free core accounting system, while QuickBooks Online follows a tiered subscription model with varying features.

Wave Pricing

Service | Cost | Details |

Accounting & Invoicing | Free | Includes unlimited invoicing, expense tracking, and basic reports. |

Payments Processing | Per Transaction Fees | - Credit Card Processing: 2.9% + $0.60 per transaction for Visa, Mastercard, and Discover; 3.4% + $0.60 per transaction for American Express. - Bank Payments (ACH): 1% per transaction with a $1 minimum fee. |

Payroll Services | $40/month base fee +$6 per active employee/contractor | Available for businesses needing payroll management. |

Receipt Scanning | $8/month or $72/year | Unlimited receipt uploads via mobile app, desktop, or email. |

Bookkeeping Services | Starting at $199/month | Access to professional bookkeeping support. |

✅ Best for: Freelancers & small businesses needing free, simple accounting.

QuickBooks Online Pricing

Plan | Regular Price | Discounted Price | Features |

Simple Start | $35/month | $17/month for 3 months | Basic invoicing, expense tracking, and one user access. |

Essentials | $65/month | $32.50/month for 3 months | Includes all Simple Start features plus bill management and time tracking for up to three users |

Plus | $99/month | $49.50/month for 3 months | Adds inventory tracking and project profitability features for up to five users. |

Advanced | $235/month | $117.50/month for 3 months | Offers advanced reporting, dedicated account manager, and supports up to 25 users. |

Payroll Add-On | Starting at $45/month +$5 per employee | N/A | Full-service payroll with automated tax filing. |

✅ Best for: Growing businesses needing advanced financial tracking & automation.

Features and Functionality Comparison: Wave vs. QuickBooks Online

Both Wave and QuickBooks Online offer core accounting tools, but their depth and functionality differ significantly. Below is a detailed feature-by-feature comparison of both platforms.

1. Invoicing & Payments

Feature | Wave | QuickBooks Online |

Invoice Creation | Unlimited, customizable invoices | Advanced invoicing with automation |

Recurring Invoices | Available | Available with auto-reminders |

Online Payments | Paid add-on with Stripe integration | Integrated payment processing (fees apply) |

Late Payment Reminders | Basic manual reminders | Automated payment reminders |

Verdict: QuickBooks Online provides more automation for invoicing, making it ideal for businesses needing efficiency. Wave is cost-effective but lacks automation.

2. Expense Tracking & Categorization

Feature | Wave | QuickBooks Online |

Manual Expense Entry | Available | Available |

Bank Connection | Limited connections | Extensive bank sync support |

Auto-Categorization | Not available | Smart AI-powered categorization |

Receipt Scanning | Limited | Unlimited with mobile app |

Verdict: QuickBooks Online wins for its automation and AI-powered tracking, while Wave is better for basic manual expense tracking.

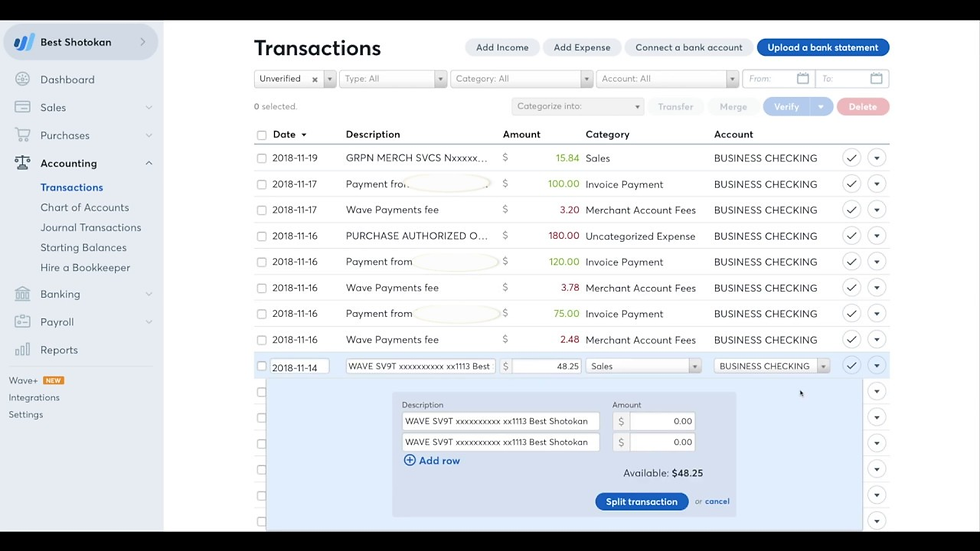

3. Bank Reconciliation

Feature | Wave | QuickBooks Online |

Bank Feed Sync | Manual upload required | Automatic sync with transactions |

Transaction Matching | Basic reconciliation | AI-driven automated matching |

Reconciliation Reports | Basic reports | Advanced reconciliation reports |

Verdict: QuickBooks Online excels at automated reconciliation, while Wave requires manual effort to match transactions.

4. Inventory Management

Feature | Wave | QuickBooks Online |

Inventory Tracking | Not available | Included in Plus & Advanced plans |

Stock Level Updates | Not available | Auto-updates stock in real-time |

Cost of Goods Sold (COGS) | Not available | Tracks COGS for financial accuracy |

Verdict: QuickBooks Online is the clear choice for businesses that manage physical products and stock, as Wave does not offer inventory management.

5. Payroll & Employee Management

Feature | Wave | QuickBooks Online |

Payroll Integration | Paid add-on | Paid add-on |

Automated Tax Filings | Limited support | Full tax compliance included |

Direct Deposit | Available | Available |

Employee Benefits | Not available | Available with higher-tier plans |

Verdict: QuickBooks Online provides better payroll automation and tax filing compliance, making it the preferred choice for businesses with employees.

6. Reporting & Analytics

Feature | Wave | QuickBooks Online |

Profit & Loss Statements | Available | Available with customization |

Tax Reports | Basic reporting | Advanced tax reports & filing support |

Cash Flow Insights | Basic overview | Detailed cash flow analysis |

Custom Reports | Not available | Available in higher-tier plans |

Verdict: QuickBooks Online provides more customization and deeper insights, while Wave offers basic reports suitable for freelancers and small businesses.

7. Multi-User Access & Collaboration

Feature | Wave | QuickBooks Online |

Number of Users | Unlimited | Limited by plan (1-25 users) |

User Roles & Permissions | Not available | Customizable permissions per user |

Accountant Collaboration | Basic export options | Direct accountant access with tools |

Verdict: Wave allows unlimited users, but QuickBooks Online offers role-based access and collaboration tools, making it better for growing teams.

8. Third-Party Integrations

Feature | Wave | QuickBooks Online |

Number of Integrations | Limited | 750+ integrations |

eCommerce Compatibility | Basic options | Shopify, Amazon, WooCommerce, etc. |

CRM & Payment Gateway Support | Limited | Extensive app marketplace |

Verdict: QuickBooks Online is the clear winner with hundreds of integrations, while Wave supports only basic payment processing.

Conclusion: Which Accounting Software is Right for You?

Choosing Wave vs QuickBooks depends on your business size, financial needs, and budget.

Wave is the best option for freelancers, solopreneurs, and very small businesses looking for a free and easy-to-use accounting solution. It provides essential invoicing, expense tracking, and reporting without any subscription fees, making it ideal for those with simpler financial management needs. However, it lacks advanced automation, integrations, and inventory tracking, which may limit scalability.

QuickBooks Online is the better choice for growing and established businesses that need advanced features, automation, and deeper financial insights. With its comprehensive reporting, expense tracking, payroll, and inventory management, it’s a powerful tool for businesses looking for long-term financial control. Though it comes with a subscription cost, its efficiency, integrations, and automation capabilities can save businesses time and effort in the long run.

For those looking to try QuickBooks Online, there’s a limited-time offer of 80% off for 8 months—making it an affordable way to explore its full potential. Claim the offer here.

Ultimately, the right choice comes down to your business complexity, budget, and growth plans. Wave is great for those who want a free, no-frills solution, while QuickBooks Online is ideal for businesses that need robust, automated accounting. 🚀

%20(300%20x%20350%20px.png)

%20(3).png)

.png)

%20(460%20x%20280%20px)%20(500%20x%20600.png)

.jpg)

.jpg)